ADVERTISEMENT: PRODUCTS FROM OUR PARTNERS

$300 Banking Bonus Offers

For new Bank of America Advantage Banking customers. Details:

- NEW! $300 Bonus Offer (online only). See offer page for more details

- Limited Time Offer expires May 31, 2025

- Member FDIC

- Cash Back on Debit Card Purchases with BankAmeriDeals®

I personally bank with Bank of America, and I’ve been recommending this deal to my friends and family. Click here to learn more details about the $300 bonus offer.

Earn Cash Back on Debit Card Purchases

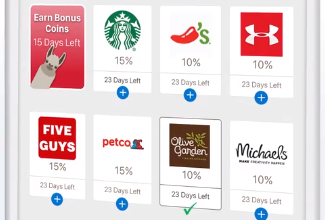

When you use the mobile app you get free access to a deals portal called BankAmeriDeals. You can earn cash back at your favorite stores and restaurants. For example I’ve seen great deals from Amazon Fresh, Little Caesars, Dunkin Donuts, Disney+, Panera, Dell, Estee Lauder, Hello Fresh, AT&T, Stitch Fix, El Pollo Loco, Dave & Busters, Adidas, and H&M, just to name a few (see screenshots).

Deals are frequently added, removed, and refreshed, so you may not see the exact same deals as I did. I recommend checking in frequently to get the most out of the program.

Who doesn't love earning some nice cash back from their debit card?

Bank of America’s website lists an upcoming deadline for the $300 bonus offer. I recommend getting this deal quickly. Click here to apply for the $300 bonus offer.

If you already have a Bank of America checking account, SoFi has a $50 bonus offer with qualifying Direct Deposits1, no account fees and no overdraft fees.3

If you’re looking for a high yield savings account, the CIT Bank Platinum Savings Accounts offer 4.10% APY on balances of $5,000 or more.

-

APY 4.10% on balances of $5,000 or more

-

MINIMUM DEPOSIT $100

-

FEES No account opening or monthly service fees

1 New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 1/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC.

SoFi members with Eligible Direct Deposit can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.80% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

3 We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Checking & Savings Fee Sheet for details at sofi.com/legal/banking-fees/.